Application – Applicant tab

The Applicant tab displays information about the Applicant’s details and what’s already been provided such as names, address and identification.

![]()

1 - Primary Applicant/Add Applicant

Customer-submitted forms are received through Nimo’s staff portal, within the Application layer, where lender staff can review, edit, or update the information as needed.

The Applicants tab is specifically designed for viewing and updating applicant details, or for adding an additional applicant to the loan application.

When a blue bubble with a number appears, it indicates that there are still required fields that need to be completed before the section is considered fully captured.

In the example below, the application still requires three pieces of information to be completed.

After selecting the ‘Applicants‘ tab, the image below shows that the primary applicant has one outstanding required item, while the additional applicant has two items that still need to be completed.

Applicants Tab

This section contains all the details that an applicant has filled out in the loan application form. Here, a user can view or update the applicant by manually editing the form under the ‘Actions’ column.

- Questions – Displays the questions asked to the applicant in the loan application form.

- Value – Shows the answers provided by the applicant.

- Actions – Allows the user to manually edit and update the answers provided by the applicant.

- Required – Indicates whether a question is mandatory.

- Provided – Shows whether the applicant has answered the question.

- Colour Indicators –

- Green: The applicant has answered the required question.

- Red: The applicant has not answered a required question.

- No Colour: Not a Mandatory Question and has not been answered by the applicant.

To proceed with the application, the user will need to update any fields that have a ‘Red tick’ in the required field. See below for some examples.

Example 1

Here we can see the primary applicant hasn’t completed the question on their ‘Previous residential address‘. Once the information is attained from the applicant, the user can simply edit the information here.

After clicking edit, a dialog box will open with an address selector to choose the address. Lastly, a reason for the change will need to be provided which will create an audit log of the action.

Example 2

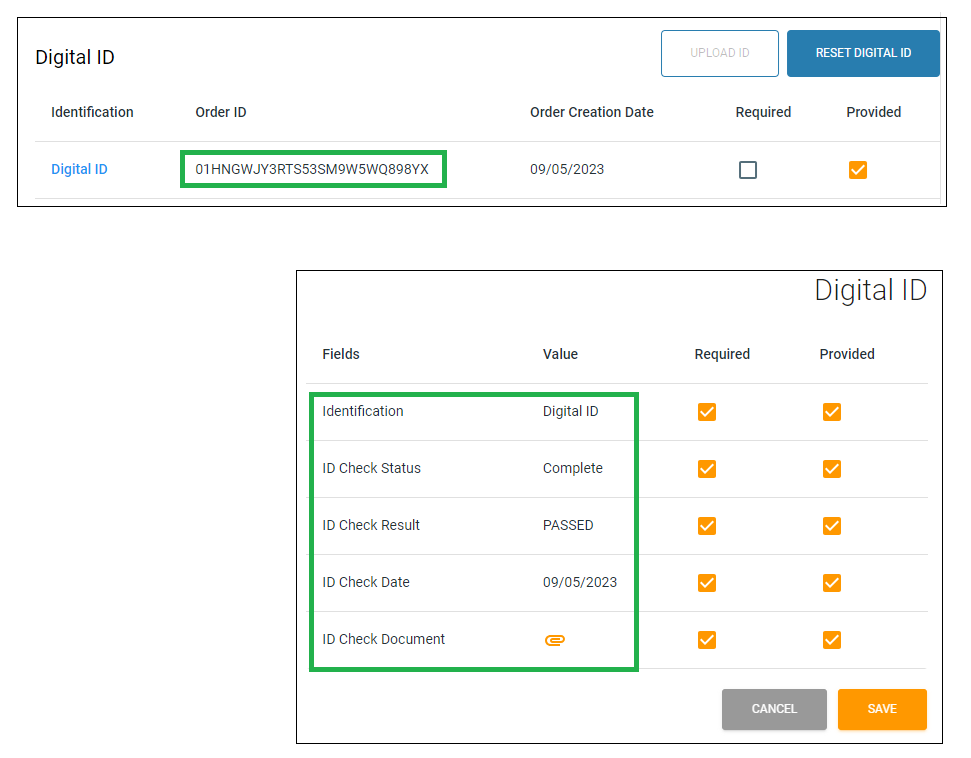

Under the Additional Applicant tab we can see the following section appear red; ‘ ‘Digital ID’. We can also see there is an ‘Order ID’ which indicates the Digital ID has been requested by the lender from the order date. This would have sent an email and/or a SMS asking the customer to click on a link to complete their ID. If this has expired, the user can ‘Reset Digital ID’ and then process the ID order again so the applicant receives a new request to complete the ID (full process available below in the ‘Digital ID‘ section. Alternatively, the ID can be uploaded by the user in the staff portal via the ‘Upload ID’ button.

2 - Edit

Changes to any section in the application layer will display a pop-up requesting a comment on the reason for the change.

Once entered and saved, a change log record is generated, displaying the old and new values and the reason for the change.

3 - Required/Provided

This section displays the applicant’s responses to the loan application form, specifically in relation to the loan product. The user can edit each individual question on the form, and you can also choose between making the question ‘required’ or ‘optional’ for the customer to answer.

- Required – shows whether a question is mandatory. If this field is checked, then the ‘Provided‘ field must be completed, otherwise it will spawn a blue bubble indicating something is still required. If the required box is unticked, it is optional for this to be provided.

- Provided – shows whether the applicant has answered the question or provided the required document or amount of documents.

- Colour Indicators –

- If both fields are green, it means all mandatory questions have been answered.

- If either field is red, it indicates that required details are still missing.

- If the user wants to update any information, they can do so by clicking the edit icon under the Actions column.

! IMPORTANT: If the user wants to update any information, they can do so by clicking the edit icon under the Actions column.

4 - Change log

All changes made by the user will be recorded in the change log for tracking and audit purposes. The details recorded in the change log are as follows:

- The User that made the change

- The Date & Time of the change

- The Attribute that was changed

- The previous value before the change, the Old Value (appears in red)

- The new value after the change, the New Value (appears in green)

- The Reason for the change if it’s been provided

Digital ID

When Digital ID is completed, the first name and surname of the customer will be labelled as ‘LOCKED’ but underlined to indicate that if you have the authority, you can edit it.

Nimo is setup that in most cases, Admin & Sales DLA Level 3 have the authority to modify the customer’s name in the Applicants tab

The order ID indicates the digital ID has been initated.

![]()

Frequenty Asked Questions

1. Why does the Digital ID still say it's not provided when I uploaded the customers document?

It’s possible your organisations policy requires more than one ID Type to be uploaded or both the front and back of a particular ID Type. In this case the Digital ID won’t be satisfied until the required quantity of images have been met.

As an example, a lender might require two forms of ID per applicant and for a Drivers Licence, both the front and back. In this example, the requirement for the Digital ID capture won’t be satisfied until all 3 images have been uploaded.

2. Can I manually update the customers address?

Yes you can. It’s likely the address is conflicting with an address dataset Nimo uses such as google maps. You can type the customers address in manually to fix this using the edit function in the Applicant tab in the Application layer.

Why can I not find the address? There are a few scenarios that could prevent you from finding the applicants address;

- Example 1: As I type in the address i can see it and select it, but then part of the address changes – It may be conflicting with the format stored in a different national dataset.

- Example 2: The address doesn’t come up in the drop down selection – When customers move into newly built homes, their address may not exist in national systems yet.

- Example 3: The address doesn’t come up in the drop down selection – It could be the format in which you are typing in the address. If the address relates to a credit check requirement, please reach out to your credit Bureau provider for format guidance

To update the address manually:

STEP-1: Click the Edit button next to the address under the applicant tab

STEP-2: Enter some random characters to bring up the ‘Can’t find your address? Enter it manually’ option

STEP-3: Enter the address manually ensuring all the mandatory fields have been addressed and confirm the changes. Describe the reason for the address change. E.g. “The address didn’t appear in the system”.

NOTE: A change log entry will be left on the right hand side of the screen for auditing.

3. What is ITRs?

Leverages illion’s Bank Statements data and credit scoring, iTRS provides powerful new insights into applicants’ financial behaviour. To view complete details of these ratings systems, contact your Illion representative.

Example as per Experian (Illion) website: Transaction data patterns that are indicative of applicant risk

- Applicants with BNPL fees show 70% higher bad rates than those without BNPL fees

- Applicants who sign up for direct debits are 20% lower risk than those who don’t

- Presence of Debt Collection activity means 120% increase in credit risk.

4. How does OCR Labs and Illion bank statements satisfy KYC Requirements?

OCR Labs satisfies KYC via referring to the DVS and using government issued forms of identifications.

Illion bank statement assists with safe harbour procedures as we use this as an additional form of identification.

This is because we recognise that the bank and lenders have already verified the customer’s identity as part of their onboarding process.

5. What about Australian foreign tax regulations?

In Australia, there are two main foreign tax regulations that govern international taxation and the reporting of foreign income. These regulations are:

Foreign Account Tax Compliance Act (FATCA): FATCA is a U.S. legislation that aims to combat tax evasion by U.S. taxpayers with financial accounts held outside of the United States. Australian financial institutions are required to comply with FATCA and report financial accounts held by U.S. persons or entities to the Australian Taxation Office (ATO). The ATO then shares this information with the U.S. Internal Revenue Service (IRS) under the terms of a bilateral agreement.

https://www.ato.gov.au/business/third-party-reporting/fatca-reporting/

Common Reporting Standard (CRS): The CRS is an international standard developed by the Organisation for Economic Co-operation and Development (OECD). It requires financial institutions in participating countries, including Australia, to collect and report financial account information of foreign tax residents to their local tax authorities. This information is then automatically exchanged between countries to facilitate the exchange of tax-related information and detect tax evasion.

https://www.ato.gov.au/general/international-tax-agreements/in-detail/common-reporting-standard/