Assessment – Serviceability tab

This section provides the business with the applicant’s monthly income and expenses, giving a clear view of their financial capacity and repayment ability.

![]()

1. Refer

The Serviceability Summary status is indicative of the 3 sections below:

- Aggregate

- Applicant/s (Primary & Secondary)

- Expenses

The Serviceability Summary status is controlled by the individual statuses of the 3 aforementioned sub-sections (Aggregate, Applicant & Expenses), meaning, if one section requires the application to be ‘referred‘, then the Serviceability Summary will say ‘Refer‘ (see Image 1 below). Alternatively, if one section shows ‘Reject’, the the Serviceability Summary will say ‘Reject’ (see Image 2 below).

A flag indicator shows when an outcome has been manually reviewed and updated (See Image 3 below). When this occurs a Manual note is also left in the system (see section 6. ‘Manual Evaluation Notes’ on this page).

2. Aggregate

This section provides a consolidated view of both the applicant’s income and expenses.

- Metrics – Displays the values being assessed.

- Requirements – Defines the condition to be met.

- Parameter – Shows the target value for assessment.

- Actual Value – Represents the applicant’s provided value.

- Evaluation – Indicates whether the value meets requirements or requires manual review.

- Action – Allows the user to manually review and, if necessary, override the metric.

The aggregate rulesets used for each organisation will differ according to organisations credit policies. To view a complete list of the available assessment rules and calculations, visit the Assessment Pipeline & Rulesets support page.

3. Primary Applicant

The Income assessment rulesets used for applicant income will differ between lenders. To view the complete list of rulesets available in the Serviceability pipeline, visit the Assessment Pipeline & Rulesets support page.

Income/s

- Income employment: refers to the primary income source of the customer.

- Additional income: refers to bonuses, commissions, and other earnings that a customer can receive throughout the year. This type of income can be weighted within the assessment pipeline ruleset.

- Other income: refers to other sources of income such as rental income, family allowances, etc. This type of income can also be weighted accordingly based on credit policy via the assessment pipeline ruleset under “Other Income.”

4. Expenses

The Liability rulesets assessed for loan expenses will differ between products and the rulesets used. To view the complete list of rulesets available in the Serviceability pipeline, visit the Assessment Pipeline & Rulesets support page.

Liability Expenses

Liabilities can be calculated in one of two ways:

- Evaluation percentage: calculates the repayments at a certain percentage, such as $1,000 repayments at an evaluation percentage of 100% = $1,000 and 80% evaluation percentage is $800. This method is predominantly used for personal loans, vehicle loans, etc.

- Percentage buffers: calculate the repayments with a percentage buffered added. For example, if the loan interest is 4% and the buffer is 3%, then the serviceability repayment will be based on 7%. There is also an option to add a floor limit buffer, which is the minimum or lowest interest rate that will apply. If the actual/declared interest rate + buffer is lower than the floor rate, then the floor interest rate will be used to calculate the repayments.

Living Expenses

Traditionally, this data is retrieved automatically via the customer’s bank statements. However, if the customer chooses to update the living expense categories manually, they have the option to do so.

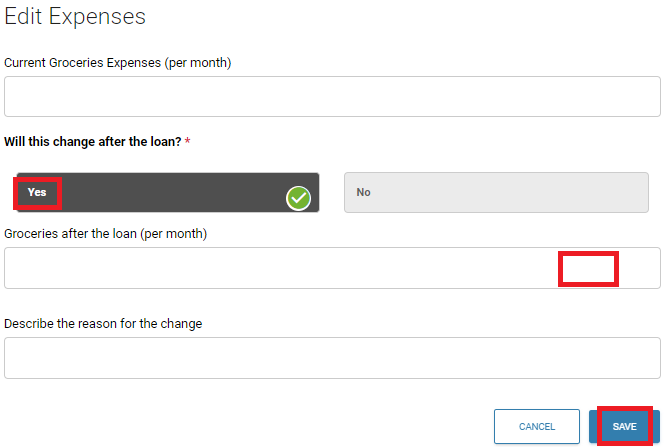

The living expenses categories also allow the customer to change the expenses per category if they anticipate a change in their expenses after loan settlement. For example, a first home buyer may have been paying rent before purchasing their first home. However, after settling their loan and moving in, they will no longer be paying rent. In this case, they can select “yes” to the question “Will this change after the loan?” and enter the new amount as $0. They can also provide a reason, such as “bought new property to live in.”

5. View Application

A quick shortcut to navigate directly back to the same application inside the Application layer from the Assessment layer

6. Manual Evaluation Notes

Nimo’s Assessment layer, uses an exception based auto-decision engine, meaning that an applicants application is assessed automatically when moving from the application stage into the assessment stage. Every instance that returns a result of ‘Refer‘ requires manual intervention before the application can proceed.

NOTE: Be careful not to update and override the entire ruleset in one action. First, click open the drop-down arrow to view all the individual rules and edit them individually.

When a user with the appropriate access level is updating the assessment outcomes, they will be asked to confirm the reason for the change. Once this is confirmed, the system will leave a manual evaluation note. To update the status, simply click on the ‘EDIT’ link that corresponds with the refer outcome.

Next, select the new status to update to.

Type your reason in for the change. For example – Checked with Credit team and the applicants income has been recorded manually after the assessment rules run. Then press ‘Save’ and the new status will be updated and reflected immediately. A ‘Manual Evaluation Note‘ will be left in the system (see image below).

7. Lock Application Edit

Allows the assessor to lock the application at which point a broker or another staff member can’t make any further edits or changes to the application.

![]()