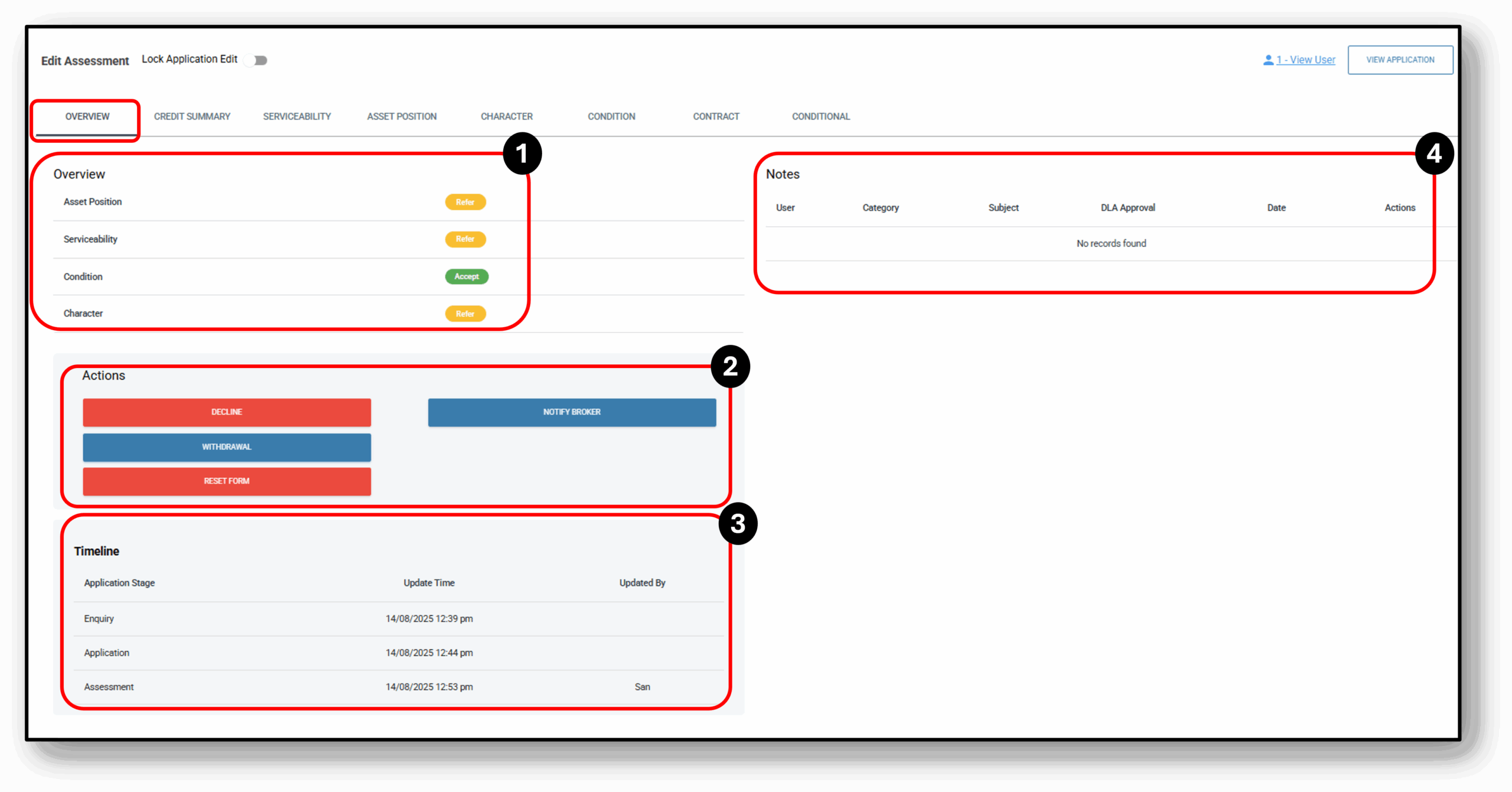

Assessment – Overview tab

This section provides the lender with an overview snapshot of the applicant’s assessment details. Any areas requiring manual review are indicated by the word “refer,” highlighted in yellow.

![]()

1a. Overview (Consumer Lending)

The assessment overview shows the credit assessor’s perspective of the customer’s application and allows the assessor to lock the application to prevent any further modifications by the customer or lender.

The credit policy guidelines are divided into four main categories:

- Asset Position

- Serviceability

- Condition

- Character

Any areas requiring manual review are indicated by the word “refer,” highlighted in yellow.

Clicking the word “refer” will navigate the user to the specific tab for review.

Once all sections are ‘Accepted’, the application is approved. Loan documents are then automatically generated and sent to the appointed solicitor, or issued digitally via NimoSign or DocuSign, depending on the lender’s preference.

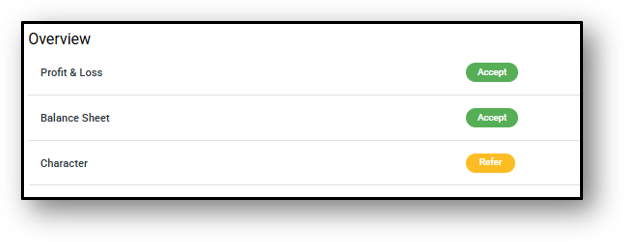

1b. Overview (Commercial Lending)

In the Overview section of the tab, the user is presented with a high level view of the applicant’s application as it appears in the Assessment stage. The three direct areas that are accessible in the overview section are:

- Profit & Loss

- Balance Sheet

- Character

Any areas requiring manual review are indicated by the word “refer,” highlighted in yellow.

Clicking the word “refer” will navigate the user to the specific tab for review.

Once all sections are ‘Accepted’, the application is approved. Loan documents are then automatically generated and sent to the appointed solicitor, or issued digitally via NimoSign or DocuSign, depending on the lender’s preference.

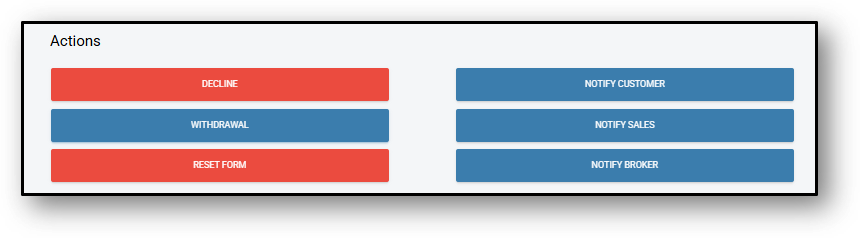

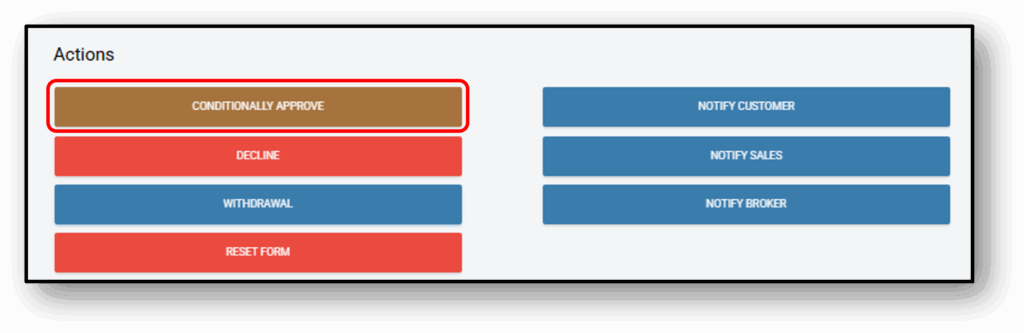

2. Actions

This section varies depending on the stage of the loan application.

Below are the actions that remain consistent throughout the loan application.

Assessment actions:

- Decline – Reject the loan application, ending any further processing.

- Withdrawal – Remove the loan application from consideration, typically at the request of the customer.

- Reset Form – This will reset Asset, Bureau Check & Income Verification.

- Notify Customer – Send an update or request additional information from the customer.

- Notify Sales – Alert the sales team about changes, updates, or required actions on the application.

For applications that are submitted via a broker:

- Notify Broker – Send an update or request additional information from the Broker.

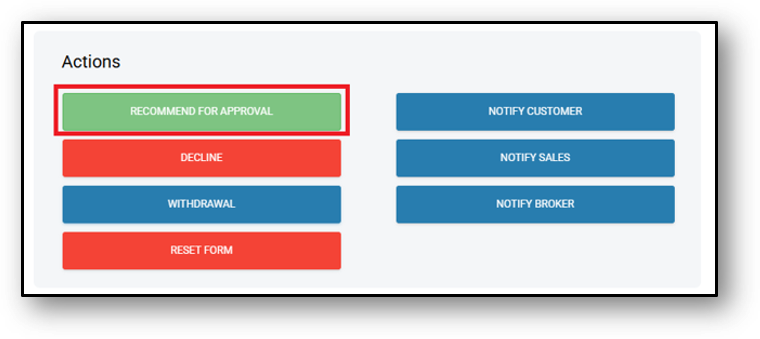

For applications ready for approval:

- Approve Loan – Appears once all required details are completed and the application is ready to be submitted for formal review.

- Recommend for Approval – Appears when the user has completed all manual checks but lacks the Delegated Lending Authority (DLA) to approve the loan.

- Conditionally Approve – This status appears when all manual checks are complete but additional documents (e.g., registration papers, roadworthy certificate) are still required. The user requests these documents, and the loan is conditionally approved, pending submission of the requested items.

After pressing the ‘Conditionally Approve’ button, several things will trigger:

- Application status moves to Conditional (see image below).

- Comms are sent to the applicant via SMS & Email to advise of the conditional approval (if your organisation has set these up).

- The ‘Conditional Approval Letter.Pdf’ will generate for the customer and await actioning.

- The customer can upload the document/s needed (in the customer portal). Once the document/s is uploaded, the approve button will show.

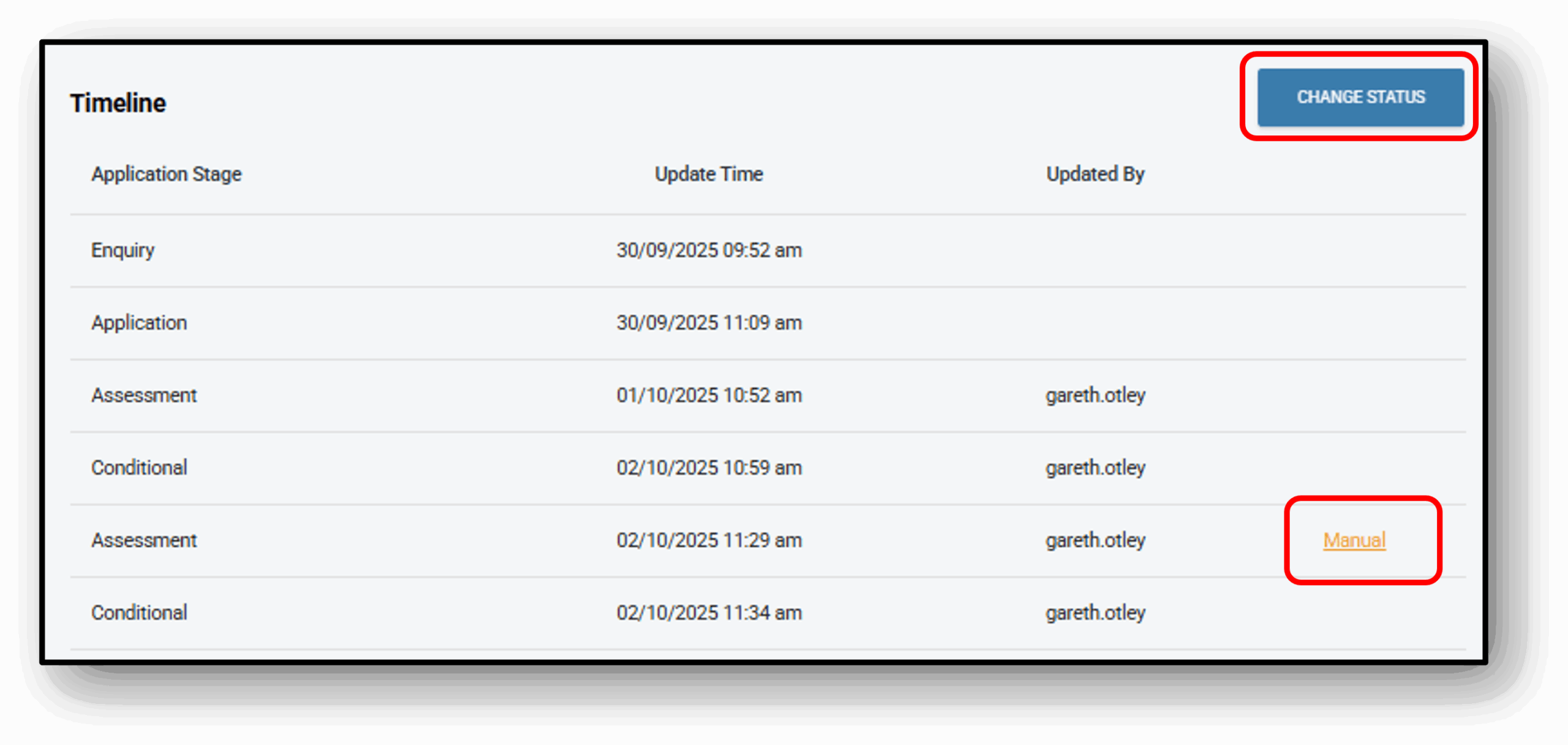

3. Timeline

This section displays the application’s stage history, including the date and time of each update and the name of the user who made the changes.

The user can ‘manually‘ update the application stage if needed by clicking on the ‘Change Status’ button.

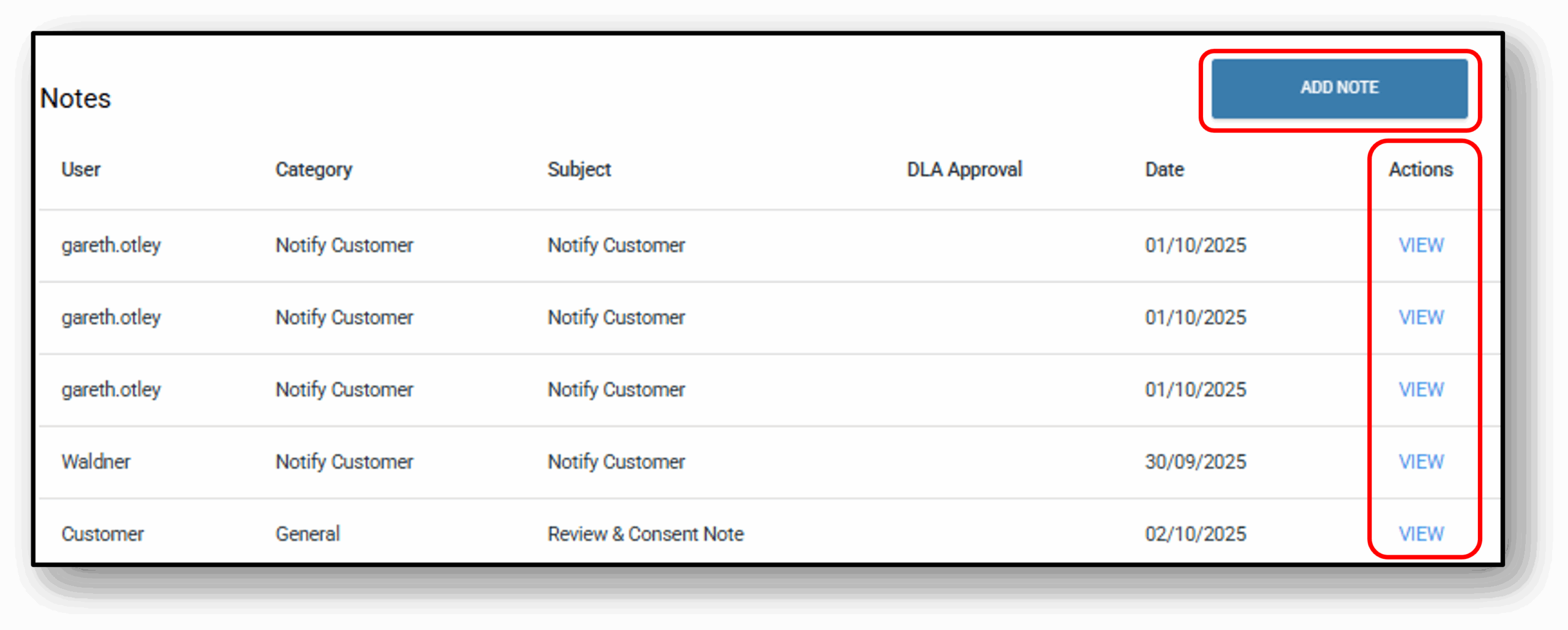

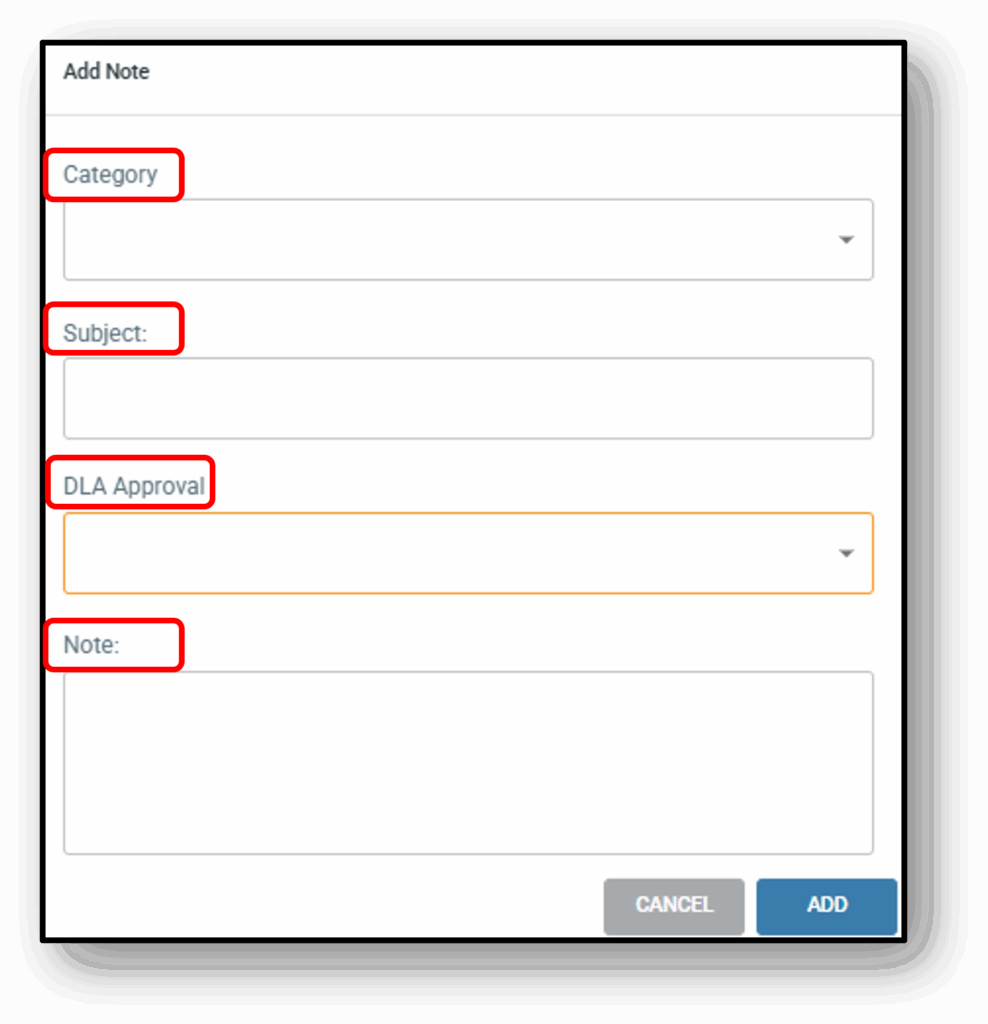

4. Notes

To add a note, click the button on the right-hand side labelled ‘ADD NOTE’. A pop-up will appear where you can add your comments and save them.

The notes include four sections:

- Category (drop down)

- Subject (free form)

- DLA Approval (drop down)

- Note (free form comments)

The Category drop down list is as follows:

- General

- Broker (brokers within the broker portal will be able to view this note)

- Transaction

- Interaction

- Credit

- Policy Exception

- Rate Approval

- Important

- Notify Staff

- Notify Customer

- Dispute

- Warning

- Fraud

- Collections

- Hardship

- Write Off

- Settlement Conditions

- Other

The DLA Approval drop down list is as follows:

- Staff

- Credit Assessor

- Credit Manager

- Head of Department

- Manager

- Team Lead

- Regional Manager

- Executive

- Board

- Auditor

- Regulator

![]()

Frequently Asked Questions

1. Do I need to be aware of anything before I action a status change from 'Conditional Approval'?

Yes.

If an application is in conditional status and a status change is actioned, the original conditional approval letter and any customer attachments will be lost.

It is recommended that before making any change from Conditional to Assessment status, you download the attachments and save them to the Documents tab in the application layer.

2. Can I update the loan from 'Settlement' back to 'Assessment'?

If an application is in a settlement status and the status is changed back to assessment, then moved back to settlement status, the customer profile in Nimo Servicing will not be duplicated, provided the customer details have not changed. However, due to the re-submission, a new loan number will be generated. In these circumstances, please contact Nimo to remove the redundant loan number.